Technology and evolving customer demands are having a dramatic effect on the way today’s businesses operate, especially for banks and credit unions. Banks and credit unions that have previously relied on tried and true operating models for decades. In recent years FinTech Companies have taken off by offering banking consumers a better, easier, and more on demand experience for their traditional banking needs such as peer-to-peer payments, financial advice, money management, and lending.

According to a PWC survey of global senior financial executives, 88% of respondents are increasingly concerned they are losing revenue to innovators. Many of these FinTech companies are in direct competition with banks and credit unions (or at least a part of their business). However, they bring with them innovative and cutting-edge digital banking ideas utilizing the latest technology and catering to the digital generation. In this way, these FinTech companies that are looking to disrupt the traditional banking model can actually offer great inspiration for already established institutions.

Digital Banking Inspiration from FinTech Disruptors

Here are four FinTech disruptors that are changing the way consumers bank — and that could provide inspiration for your bank or credit union.

1. Peer-to-Peer Payment Systems

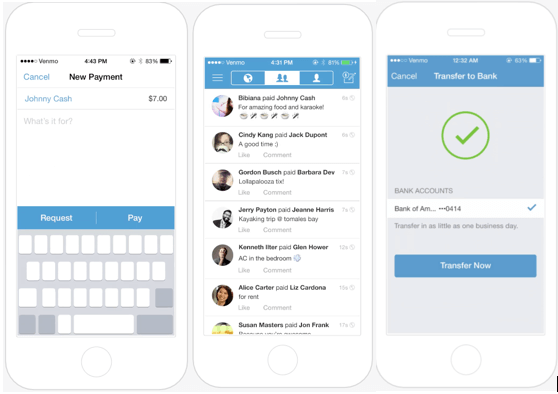

Peer-to-peer (P2P) payment systems allow people to send or request money from each other with only an app. P2P apps like Venmo gained a great deal of traction amongst the millennial generation and have since made their way to the broader consumer population. These apps continue to grow at a tremendous rate which is likely due to their constant improvement. In 2018 Venmo’s volume increased 79%. One of Venmo’s more recent changes includes offering an option for consumers to instantly transfer funds to a bank account for a small fee instead of their free transfer option that takes one to three business days. Venmo also recently launched a debit card that notifies consumers of every transaction made and enables consumers to instantly use the money they have in their account, load additional money to use, and easily split all purchases made with the card in their app.

Venmo App

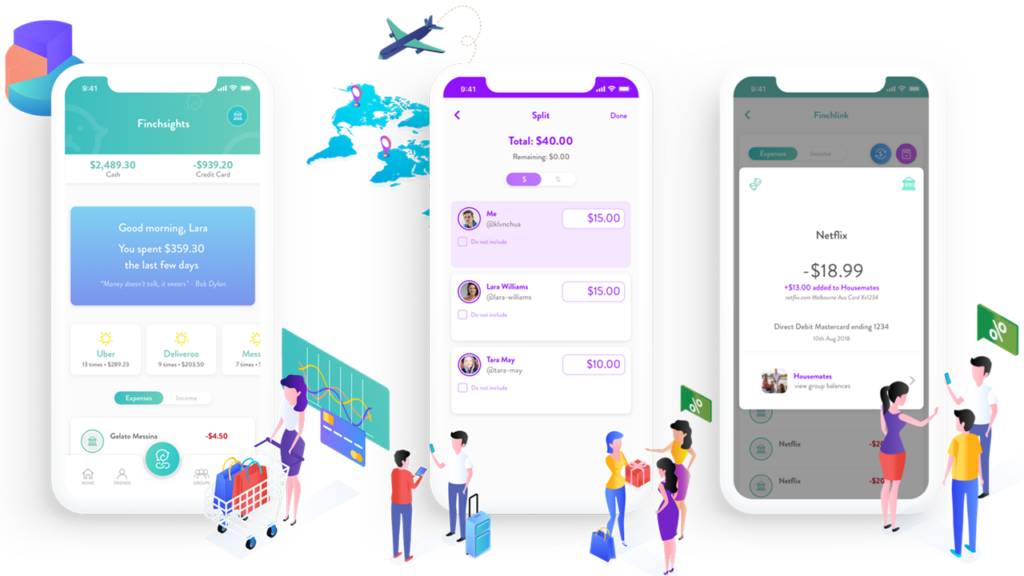

Finch is another P2P payment system created to make paying friends, splitting bills, and managing consumer finances easier. Finch uses a different approach to P2P by allowing the consumer to organize bills or payments into groups such as “Roommates” or “Hawaii Trip.” In each group, the consumer can add friends and any corresponding bills to split between the group. However, they can also choose to split bills directly from their bank feed making it extremely easy to use. Keeping payments organized by groups enables the consumer to see spending habits and gain insights into what groups have the highest spend.

Finch App

2. Artificial Intelligence (AI) and Machine Learning

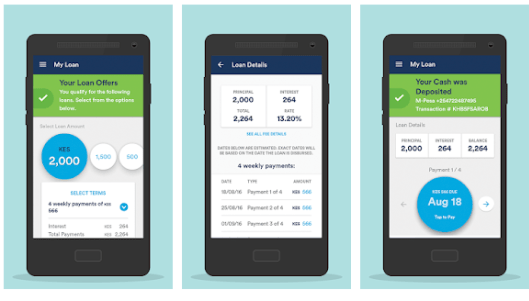

Branch App

Leading FinTech Companies like Branch.co, and ZestFinance, and MyBucks are using AI and machine learning to offer loans to consumers with little to no credit history. Branch.co assesses people’s credit based on smartphone data to determine eligibility and provides access to people who otherwise would be unapproved because of their lack of credit history. They use machine learning to process tons of data points and create personalized loan options for consumers.

MyBucks is able to approve loans within 30 minutes by using their advanced financial technology that analyzes social media data, SMS information, and financial information.

FinTechs like these are using AI to improve a previously long and complicated process of determining loan eligibility. Using their advanced data, they can offer a faster, more accurate and unbiased way to determine a consumer’s credit worthiness and their corresponding interest rate. Similarly, by removing the loan officer from the equation, these FinTech’s can save on costs and ensure a profit from their low rate loans.

3. Mobile Tech with a Twist

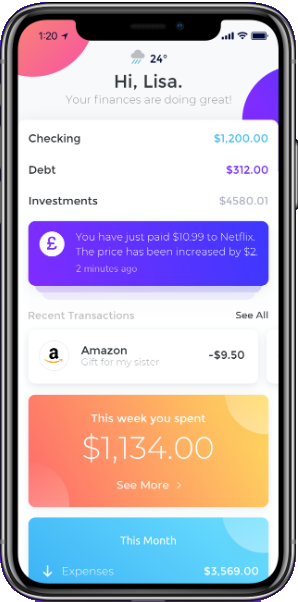

Many FinTechs are focusing on providing consumers with valuable and comprehensible insights into their spending on a daily, weekly, or monthly basis. The growing success of FinTechs that provide financial insights have proven consumers desire for an easier way to understand and track their spending without digging through a long list of banking transactions.

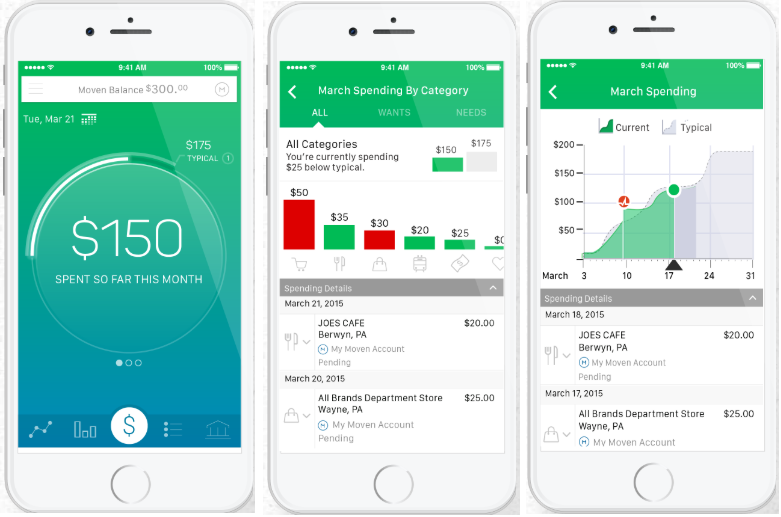

Companies like Moven provide consumers with a quick look at their spending overview so they can easily understand where they are compared to their usual spending. They also provide data for monthly spend by categories such as groceries, dining out, or shopping. Consumers can then see a comparison of their spending between categories to find areas they need to improve so they can adjust future spend.

Moven App

Similar to Moven is Emma, a personal finance management app that helps consumers track their finances, find wasteful subscriptions, and make recommendations to help save money. Emma allows its users to connect multiple bank accounts and credit cards so they can track all their transactions in one place. Consumers can also use her to set a budget and view their weekly and monthly spend.

Emma App

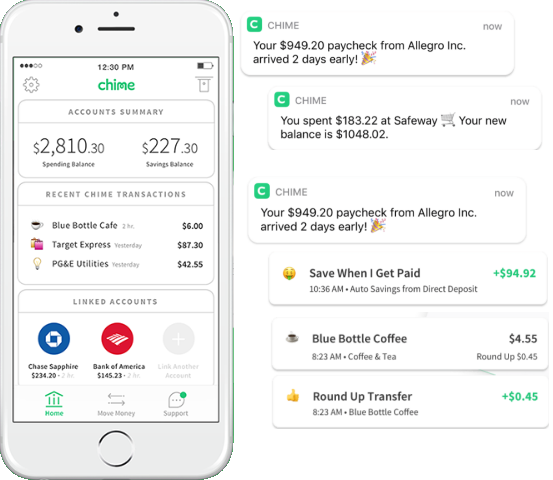

Chime is a mobile only bank that offers a checking account, a savings account, and debit card. They offer services to help their consumers save money and receive their money faster by providing consumers with their paychecks up to two days faster than their coworkers when they use direct deposit. They also help consumers build up their savings by rounding up every purchase to the nearest dollar and transferring those funds to their savings account or by allowing users to transfer a percentage of their paychecks directly to their savings. Chime also ensures users are aware of any account activity by sending transaction, transfer, and daily balance notifications to the user.

Chime App

4. Robo Advisors

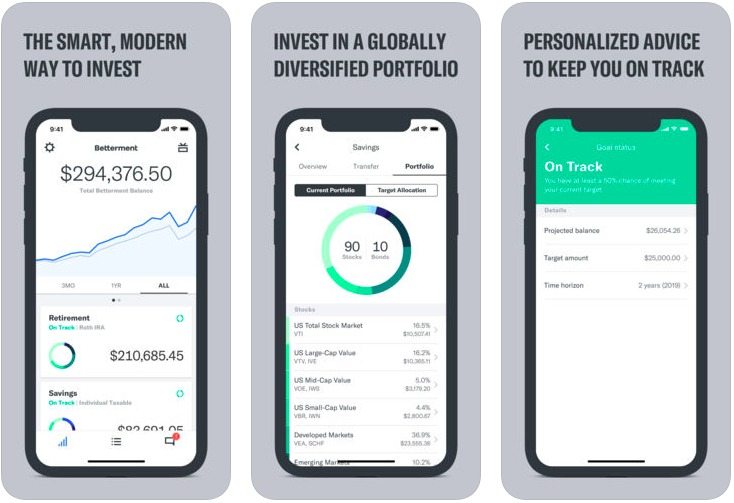

Betterment, SigFig and Wealthfront are three large robo-advisor brokerages and have grown tremendously since their start up days. Robo-advisors offer computer-generated financial advice in place of a human financial advisor. Often times the robo-advisor service requires users to take a quiz to determine their financial status and overall goals and then provides them with a suggested portfolio.

Previously, financial advice was only available to people with a wealth manager and that’s exactly why robo-advisor brokerages like Betterment or Wealthfront are so attractive to consumers. These robo-advisor FinTechs and other smaller ones provide investment advice directly to the consumer cutting out the need for the middleman (a wealth manager). By doing so these companies have created a service more accessible, easier to use, and cheaper for the consumer.

Larger banks have already jumped at the opportunity to capitalize on the success of robo-advisors by launching their own robo-advising services such as Bank of America’s Merrill Guided Investing or Wells Fargo’s Intuitive Investor which was created by SigFig and launched in 2017.

Betterment App

The FinTech Appeal

FinTech is gaining momentum because the services offered appeal to the majority of consumers today. Most FinTech companies offer the following benefits:

- Speed

- Simplicity

- Customer autonomy

- Distinct capabilities that are not part of a bundled service

It should come as no surprise that these are all extremely appealing characteristics for 21st-century consumers, especially millennials and the digital savvy.

The majority of FinTechs all share a common strategy — transferring control to the customer. This means giving consumers the reins when it comes to making the best financial decisions for them, through transparency and easy access to information.

At Engageware, we are helping banks and credit unions do just that — give their customers and members the ability to access all the information they need through digital banking channels without ever having to pick up the phone. We are helping banks and credit unions evolve with the demands of customers by providing an engaging digital experience that lowers support costs and drives more revenue through a better experience for the customer and member. With Customer Self-Service, banking customers can get rapid answers to their questions 24/7 reducing customer frustration and call volumes. Our Appointment Scheduling solution helps banks and credit unions connect prospects and customers with the right person in your organization at the peak of their interest.