We attended BankWorld, the Connecticut Bankers Association bank show at the Mohegan Sun Casino.

When we weren’t taking your questions & answers at the booth (come find us at other conferences this year), we attended some great sessions on trends in the financial realm today.

One of the most resounding sessions was presented by Bruce Paul, Managing Director at Rivel Banking, titled, First Look: What Are Your Banking Benchmarks?

In the session, Bruce provided a first glimpse of the latest Rivel Banking Benchmarks report. The focus of this year’s report is the state of Northeast banking customers’ opinion of their current financial institution and propensity to switch.

Bank switching behavior on the rise

It’s the billion (trillion?) dollar question: what will bank consumers do this year? Particularly – will they stay or will they go?

Financial switching behavior has been a trending topic in recent years. With various sources and studies reporting upwards of 1 in 4 consumers thinking about switching their primary financial institution, and 11% having already done so in 2017, it remains a highly important question on the hearts and minds of banks and credit unions.

What’s more is that the act of switching financial institutions is no longer perceived as cumbersome and difficult. A 2017 Accenture Consulting study on North American Consumer Digital Banking found that switching is not an obstacle, with 80% of consumers viewing their banking relationships as transactional, thus making it easier to cut ties.

As reported by Financial Brand, a study by Resonate found that the top reasons consumers are switching their FI are for:

- Lower rates / fees

- More convenient branch locations

- Better online / mobile banking services, and

- Better customer service.

What this demonstrates is that the core aspects of brick-and-mortar banks and credit unions still matter and are so widely valued that poor marks on customer service and local proximity (branch locations = convenience, community, local ties and loyalty) would be so much as to send them looking for an alternative FI.

What bank consumers say they will do in 2019

The benchmarks report presented by Rivel’s Bruce Paul echoed similar findings.

“Everyone’s concerned about ‘switching behavior,’” stated Bruce at the onset of the presentation. “They want to know, who’s switching banks? Why? And, who will win out?”

According to the Rivel benchmark report, a double-blind study of households in the greater New England area, 26% of New England households and nearly a third of New England businesses are vulnerable consumers. This represents nearly 2.3 million households and businesses in the northeast that are either actively looking or could be easily enticed to switch banks.

Of those who are “defecting” i.e. intent on leaving their bank today — it’s 9% of New England households, and 13% of New England businesses. These individuals are actively shopping around, but may not all end up leaving their current institution.

A few other interesting tidbits from the sneak peek of the Rivel Banking Benchmarks research presented by Bruce:

- Just under a half of New England’s consumers are “loyal” to their current financial institution.

- Sentiment varies widely among counties, even those geographically close to each other. The implication for banks and credit unions? Know your audience(s) and be aware that you may have to market differently in one area than you do a few miles down the road.

- High income households are 43% more vulnerable and less happy with their current institution.

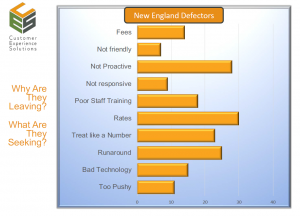

Why consumers are leaving their bank

When it comes to why consumers are intent on leaving their current banking provider, it may not be what you expect. When polling the BankWorld audience, the majority presumed technology (or lack, thereof) was the primary reason for defecting. Much to the audience’s surprise, it wasn’t in the top 3, or even top 5 reasons.

New England consumers surveyed by Rivel say they would leave their bank because of:

- Rates

- Their current bank is not proactive enough. In other words, consumers feel their financial institution is not helping them out, not telling them about new ideas, offers, etc.

- Getting the runaround. Meaning, it takes on average more than one touch point and/or employee interaction to get a question answered.

What this confirms is three things:

- Consumers want to have an ongoing, engaging relationship with their bank or credit union, where they know and can trust that they’re being taken care of. This means being made aware of the best offers to further their financial interests, and continuously advised. It’s more than OK to reach out to your members or customers with promotions or special offers! Marketing is key not only to growth of your institution, but to customer retention.

- Consumers also expect to get one version of the truth from their financial institution. They expect the same, accurate, and direct answers from all bank employees – whether it be the frontline at a branch or a call center.

- Consumers are frustrated with employees not knowing the answer. Accurate and effective employee training is a critical preventive measure to avoid giving your consumers “the runaround.”

The path of Millennials

Millennial consumers in New England surveyed by Rivel say they would leave their bank because:

- Their current bank is not proactive enough.

- Getting the runaround (you have to ask more than one person to get an answer).

- Fees.

- Poor staff training.

Surprisingly, technology is one of the least important frustrations Millennials have. On this notion, Financial Brand notes, “Innovation — or the lack of it — is not necessarily the reason people plan to switch banks, but it is a quality they look for once they’ve made the decision.” Innovation is a desirable attribute of a banking product, one that financial institutions should pay attention to as they think about their online and mobile banking offerings. But, innovation is not necessarily that of utmost importance when it comes to customer retention — at least not presently.

Like the general population surveyed for the Benchmarks report, Millennials, too, would like to hear more often from their bank.

Resonate’s study also found that consumers feel that their banks “do not communicate with them often enough, and generally don’t feel valued as a customer.”

Who will win

So, what banks will win over the defectors and disillusioned consumers? Those who provide exactly what consumers say their current financial institution lacks, or causes them the most frustration. Banks that proactively provide solutions to their customers, don’t give the runaround, and have well trained employees. in other words, institutions where “one version of the truth,” so-to-speak, prevails.